Bridging global capital with premier U.S. hotel assets through strategic acquisitions and innovative investment models.

RealFi Network connects global investors with exclusive hotel acquisitions and developments. Our structured investment model enhances access, liquidity, and operational efficiency across premium hospitality assets.

RealFi targets undervalued hotel assets and high-growth markets, leveraging institutional insights to maximize investor returns.

Explore More

Partnering with CBRE, Jones Lang LaSalle, and Aimbridge, we ensure top-tier operational efficiency for long-term asset value growth.

Explore More

Through innovative investment structures, RealFi enables accredited investors worldwide to participate in prime U.S. hotel assets.

Explore MoreDiscover how RealFi Networks is transforming hotel acquisitions and new developments into high-performing investment opportunities. Watch the video to see how we provide global investors with exclusive access to premium hospitality assets.

Gain Access to Institutional-Grade Hotels

Participate in Prime Hospitality Developments

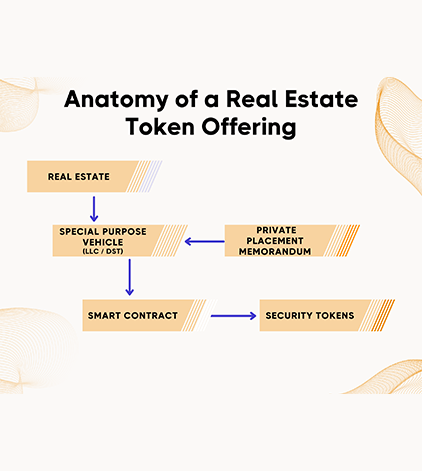

There are several notable case studies of successful tokenized properties and real estate projects that have demonstrated the success of blockchain-based tokenization in the real estate industry.

The real estate market faces acute challenges, including high investment barriers, limited liquidity, and accessibility constraints for individual investors, and international investor accessing the U.S. market.

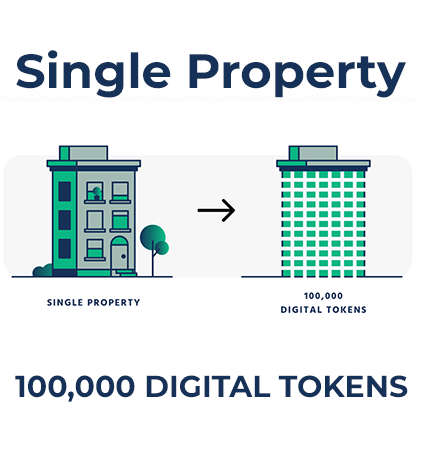

High unit values in real estate create a significant barrier for potential investors. Traditional real estate investing often requires substantial capital commitments, making it inaccessible for many individuals. With residential property prices starting around $50,000 and luxury or commercial units valued in the millions, these high investment thresholds deter those who lack the resources or are unwilling to allocate such large sums to a single investment opportunity.

Fractional ownership allows multiple investors to co-own a property, reducing the individual financial burden and enabling smaller investment sizes. However, the traditional real estate market offers few opportunities for such ownership structures. While REITs (Real Estate Investment Trusts) provide one solution, they are often constrained by stringent legal and regulatory frameworks, limiting their accessibility and appeal to a broader investor base.

The real estate market is notoriously illiquid, with selling properties often being a lengthy and complex process. High unit values and extended transaction timelines further deter investor interest, creating significant barriers to entry. These challenges not only limit opportunities for investors but also pose obstacles for property managers and construction companies seeking to optimize their portfolios and cash flow.

Real estate sales agencies often charge commissions as high as 10%, adding substantial costs to transactions. Despite these fees, property managers are still required to invest time and resources into marketing individual units, further eroding profit margins and reducing overall returns.