Empowering global investors through tokenized real estate opportunities.

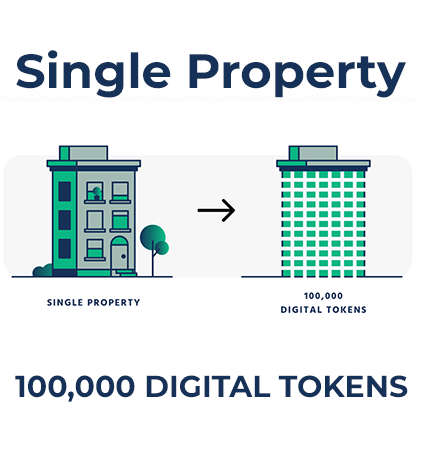

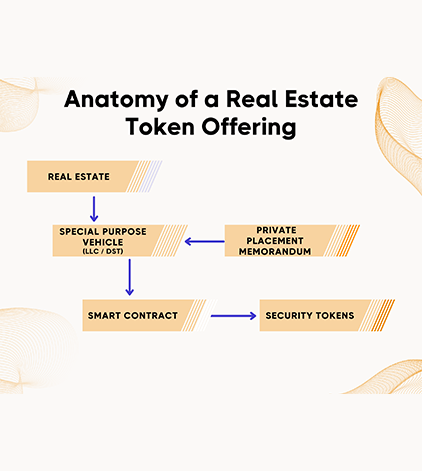

Real estate tokenization is a process in which real estate shares are created as digital tokens on a blockchain. With tokenized shares on RealFi, you have unprecedented access to private real estate investments, transparency, and liquidity.

RealFi Network's issuance process includes investor registration and verification (KYC/AML), seamless token purchases, and a streamlined electronic document workflow with digital signatures.

Explore More

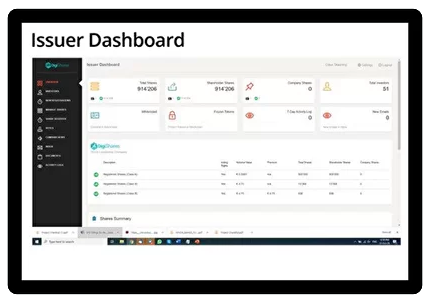

RealFi Network's Corporate Management features a tokenized shareholder register across multiple share classes, efficient investor communication and voting, seamless dividend distribution, and the ability to freeze or renew tokens as needed.

Explore More

A seamless subscription flow from the point of indicating interest, going through accreditation / KYC checks, e-signing subscription agreements, to investing.

Explore MoreDiscover how RealFi Networks is expanding real estate investments through tokenization. Watch the video to learn how we provide unparalleled access to U.S. markets, including hotels and single-family rentals.

Access Premier U.S. Markets

Invest in Hotels & Single Family Rentals

There are several notable case studies of successful tokenized properties and real estate projects that have demonstrated the success of blockchain-based tokenization in the real estate industry.

The real estate market faces acute challenges, including high investment barriers, limited liquidity, and accessibility constraints for individual investors, and international investor accessing the U.S. market.

High unit values in real estate create a significant barrier for potential investors. Traditional real estate investing often requires substantial capital commitments, making it inaccessible for many individuals. With residential property prices starting around $50,000 and luxury or commercial units valued in the millions, these high investment thresholds deter those who lack the resources or are unwilling to allocate such large sums to a single investment opportunity.

Fractional ownership allows multiple investors to co-own a property, reducing the individual financial burden and enabling smaller investment sizes. However, the traditional real estate market offers few opportunities for such ownership structures. While REITs (Real Estate Investment Trusts) provide one solution, they are often constrained by stringent legal and regulatory frameworks, limiting their accessibility and appeal to a broader investor base.

The real estate market is notoriously illiquid, with selling properties often being a lengthy and complex process. High unit values and extended transaction timelines further deter investor interest, creating significant barriers to entry. These challenges not only limit opportunities for investors but also pose obstacles for property managers and construction companies seeking to optimize their portfolios and cash flow.

Real estate sales agencies often charge commissions as high as 10%, adding substantial costs to transactions. Despite these fees, property managers are still required to invest time and resources into marketing individual units, further eroding profit margins and reducing overall returns.